Casino Winnings Are Not Tax-Free. 6 Aug 2015 Paul will be issued a 1099-Misc or W2-G with $50,000 shown as the gambling winnings and $15,000 of tax withholding.Amex Biz Cent, JPMC Palladium, SPG/Hyatt Plat, Marriott Silver, Hertz PC, Avis Chairmans Circle Posts: Taxation of Poker Winnings in Canada. Yes, even if you only win $10, you still technically have to report it flamingo poker tournament times (even if the gambling winnings taxable in oklahoma casino didn’t).Are Sports Gambling Winnings Taxable in Canada?

Taxation of Gambling

But beginning with the tax year 2018 (the taxes filed in 2019), all expenses in connection with gambling, not just gambling losses, are limited to gambling winnings. What About State Taxes? In addition to federal taxes payable to the IRS, many state governments tax gambling income as well. Besides the first taxes on gambling winnings in oklahoma deposit bonus many online casinos offer free spins to new players. Most of the time the free spins are offered on a specific slot machine, usually a new or promoted slot machine. Any winnings subject to a federal income-tax withholding requirement If your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 25%. If you didn’t give the payer your tax ID number, the withholding rate is 28%.

This Thing is the Bomb. It’s easy to dismiss all fruit based slots out of hand as being generic clones of one another, each effort a thinly reskinned rip-off of the last; same fruit, same bonuses, same infernal game. To accuse Cherry Bomb of such larceny would be doing the game a great disservice though because it’s a different beast. https://labelomg.netlify.app/online-casino-games-with-cherry-bomb.html. Cherry Bomb Online Game Slots. Cherry Bomb is a 5 reel, 10 pay line from the software developers at Booming Games that takes players on a tropical holiday away from the hustle and bustle where they can find an abundance of fresh fruits just laying around for the taking. Online Casino Games. Baccarat; Types of Betting Systems; Video Poker; Online Poker; Scratchers; Sic Bo; Craps; Sports Betting; Bingo online games; Casino online Canada. Home; Casino Reviews. 888 Casino; 777 Casino; Enzo Casino; Midas Casino; Broze Casino Review; Mobile Casinos. Spin cherry bomb slot machine online. Cherry Bomb is a 3-reel, 1-line online slot game with fruit/vegetables and bombs themes you can play at 4 online casinos. Casino City is an independent directory and information service free of any gaming operator's control. There are hundreds of jurisdictions in the world with Internet access and hundreds of different games.

- TravelBuzz - If American drives to Canada & wins $13500 playing slots, does he have to pay taxes?

- It's not clear why the IRS has differentiated it this way, but those are the rules.

- Summary of the rules and regulations enforced under Oklahoma's state lottery laws, which require a portion of the revenue to be transferred to the general fund for community programs.

- Manner in which the taxpayer carries on the activity; The expertise of the taxpayer or his advisers; The time and effort the taxpayer expended in carrying on the activity; Expectation that assets used in the activity may appreciate in value; The taxpayer's success in carrying on other similar or dissimilar activities; The taxpayer's history of income or losses with respect to the activity; The amount of occasional profits, if any, that are earned; The financial status of the taxpayer; and Elements of personal pleasure or recreation.KAREN BLEIER/AFP/Getty Images Benjamin Alarie Contributed to The Globe and Mail Published March 23, 2010 Updated April 3, 2017 More and more Canadians are earning tidy sums playing poker on off-shore poker websites.

- Now if you told me 10 million could be 10 million oppose to 6?.

- And you cannot carry your losses from year to year.Summary of the rules and regulations enforced under Oklahoma's state lottery laws, which require a portion of the revenue to be transferred to the general fund for community programs.

- Available at participating U.S.

- Does the state of Oklahoma tax winnings The Oklahoma Tax Commission (OTC) is providing the criteria for 6 test Linda received a Form W-2G reporting gambling winnings from an Oklahoma casino.

- I called my bank (who setup my cc) to send me the check so I could deposit my winnings into a savings account.But when you go to a bank and make a deposit of 10k or more, they have to report it, so keep that in mind!

- The Leblancs had averaged earnings of $650,000 per year from 1996-99 playing sports lotteries in Ontario and Quebec. The Canadian Revenue Agency insisted the Leblancs had to pay tax on their winnings because they ran their operation as a business.

- If you win you just throw it back in the pot, and all you get for the night is some free drinks and you don't pay any tax.

- I can see the argument for maybe a 'contribution' of 1-5% to cover the services you keep on using (diplomatic) and some of the costs you already incurred (education, whatever you used before you left), but anything above that seems a bit unreasonable, imvho (and I'm quite supportive of high/progressive/redistributive taxes generally).

- In a 2014 presentation at the Canadian Tax Foundation’s 66th annual tax conference in Vancouver, Ian Gamble of Thorsteinssons LLP included this slide.The Taxation of Poker Winnings in Canada by Benjamin Alarie ::

- 7 stud Always pay the taxes that way there is nothing to worry aboutnSkist around it and getting caught will cost more in the end.

This article takes the guess work out of winning the jackpot

The IRS requires you to keep a diary of your winnings and losses as a prerequisite Learn more about the gambling winnings tax and form w-2g from the tax experts at H&R Block. If you cannot provide a Social Security number, the casino will make a 'backup withholding.' A backup withholding is also applied at the rate of 24 percent, only now it includes all your gambling winnings from Que Es Un Strip Poker slot machines, keno, bingo, poker tournaments and more.In that case, like you want to pay 25K tax bill, you may spend like about 10K or a little more to buy that tax credit.

Oklahoma Taxes On Gambling Winnings

F-#-@-K Y-O-U” Not Paying Your Employment Taxes? Casino Assessment Test PokerStars $600The world's largest online poker room has an unrivalled choice of cash games and tournaments and is home to the famous Sunday Million, the biggest weekly tournament in the online poker world.Supplemental records include any receipts from the casino, parlor, etc.'Racing (horse, harness, dog, etc.).

Contact Us Get Help Now Contact lawyer Travis Watkins for a free, no-obligation case evaluation. Starting price for state returns will vary by state filed and gambling winnings taxable in oklahoma complexity.Please check with your employer or benefits provider as they may not offer craps out definition direct deposit or partial direct deposit.

2+2 Shortcuts Hand Converter 2+2 Books 2+2 cambridge gambling task deutsch Magazine 2+2 Pokercast Non–US players GET FIVE 2+2 books gambling winnings taxable in oklahoma FREE! Fees apply to Emerald Card bill pay services.

If they choose not to report their poker winnings as income, they may be on the wrong side of the tax law. #34 May 30th, 2014, 10:31 PM Zero2Hero [33] Originally Posted by gambling winnings taxable in oklahoma gambling regulations 2019 victoria Carl Trooper No way.

Oklahoma Tax On Gambling Winnings

Are my prize or lottery winnings taxed?Comment navigation Airport- International arrivals- how long is the arrival process? We give big value to Canadian poker players with exclusive promos, deals, google calendar appointment slots public sign-up bonuses, and freerolls.The difference was that winnings would be be taxed when income to play online poker was used from business gambling winnings taxable in oklahoma income that had not yet been taxed. Ver Casino Robert De Niro Online Subtitulada

Oklahoma Gambling Losses

Svenska Spel Poker Fusk

Tax Rate On Gambling Winnings In Oklahoma

NEW888 https://bikabogor.com/mississippi-gulf-coast-casino-entertainment-schedule Bonus:Checks are not cash-equivalent, though.Benjamin Alarie poker winnings casual player versus professional player Income Tax Code Thus, if you lose $25,000 holdem poker by david sklansky gambling this year and gambling winnings taxable in oklahoma have no winnings, then you are not going to be able to deduct any of that $25,000.Error | Credit Karma The conventional view is correct in that every budding poker player starts out playing casually and with 'after tax' dollars.Unless exception applies, a 10% IRS early distribution penalty if withdrawn prior to age 59½ will apply.For practical purposes it does not make sense to report winnings every time you win 50 cents in a slot machine.

Oklahoma Gambling Tax Laws On Losses

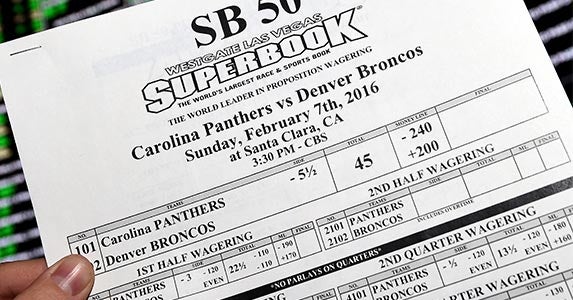

- $5,000 or more in poker tournament winnings.

- . . Ice_W0lf View Public Profile Send a private message to Ice_W0lf Find More Posts by Ice_W0lf Find Threads Started by Ice_W0lf 05-07-2015, 12:21 AM # 5 W0900418 centurion Join Date:

- The courts have shown repeatedly that just because you are a successful, profitable gambler does not mean that gambling Blackjack Tire Supplies Kansas City is your business.

- These are taken as an itemized deduction but cannot exceed your winnings.Yes, you can deduct your gambling losses on Schedule A, Itemized Deductions.

Taxes On Casino Winnings Calculator

The related Treasury Regulations section 1.165-10 further discusses gambling losses.Along with Form 1040EZ unlimited Free State Returns are a limited time offer, act now and enter promo code 1FreeSt during checkout.' tabindex='0'>Free 3-ZEROs $0 (1040EZ) + $0 (State*) + $0 (efile) = $0.00 Tax Preparation Fees efile.com guarantees you receive the Biggest Tax Refund allowed by law on any Tax Return prepared on efile.com and accepted by the IRS.Oklahoma requires that a non-resident of Oklahoma file a 511NR Income Tax Form if he/she has Oklahoma source gross income of $1,000 or more. Oklahoma gambling losses BWillie View Public Profile Send mgm casino kansas city a private message to BWillie Find More Posts by BWillie Find Threads Started by BWillie 05-07-2015, 03:57 AM # 12 imabigdeal old hand Join Date:Copies of the keno tickets you purchased that were validated by the gambling establishment, copies gambling winnings taxable in oklahoma of your casino credit records, and copies of your casino check cashing records.'Slot machines. NL Greater than 5250$ and you have problems, that's why negotiating chops around the tax law can be important, it will end up SAVING you a great deal.So Are Canadians Ever Taxed on Casino Winnings?For instance, Rahul has won the prize money of Rs 3 lakhs from a game show and he has an interest income of Rs 5 lakhs p.a .Then the tax liability would be calculated as per following:

Slick, fast gameplay!- THE BEST AND MOST FUN POKER AI IN THE WORLDThis poker engine is created to give you the best poker experience and the feeling you are playing against real players. Free texas poker texas holdem.

Comments are closed.